Understanding the Importance of Finance Training in Business

Finance is a critical aspect of any business, and understanding its intricacies is essential for success. Whether you’re a business owner, manager, or employee, having a solid understanding of finance can help you make informed decisions, manage your resources effectively, and navigate the complexities of taxation.

The Benefits of Finance Training

Investing in finance training can provide numerous benefits for individuals and businesses alike. Here are some key advantages:

1. Improved Financial Management:

Finance training equips individuals with the knowledge and skills to effectively manage their finances. By learning about budgeting, cash flow management, and financial analysis, you can make informed decisions that optimize your business’s financial health.

2. Enhanced Decision-Making:

Understanding finance allows you to make better decisions by considering the financial implications. Whether it’s evaluating investment opportunities, assessing the feasibility of a project, or analyzing financial statements, finance training empowers you to make informed choices that align with your business goals.

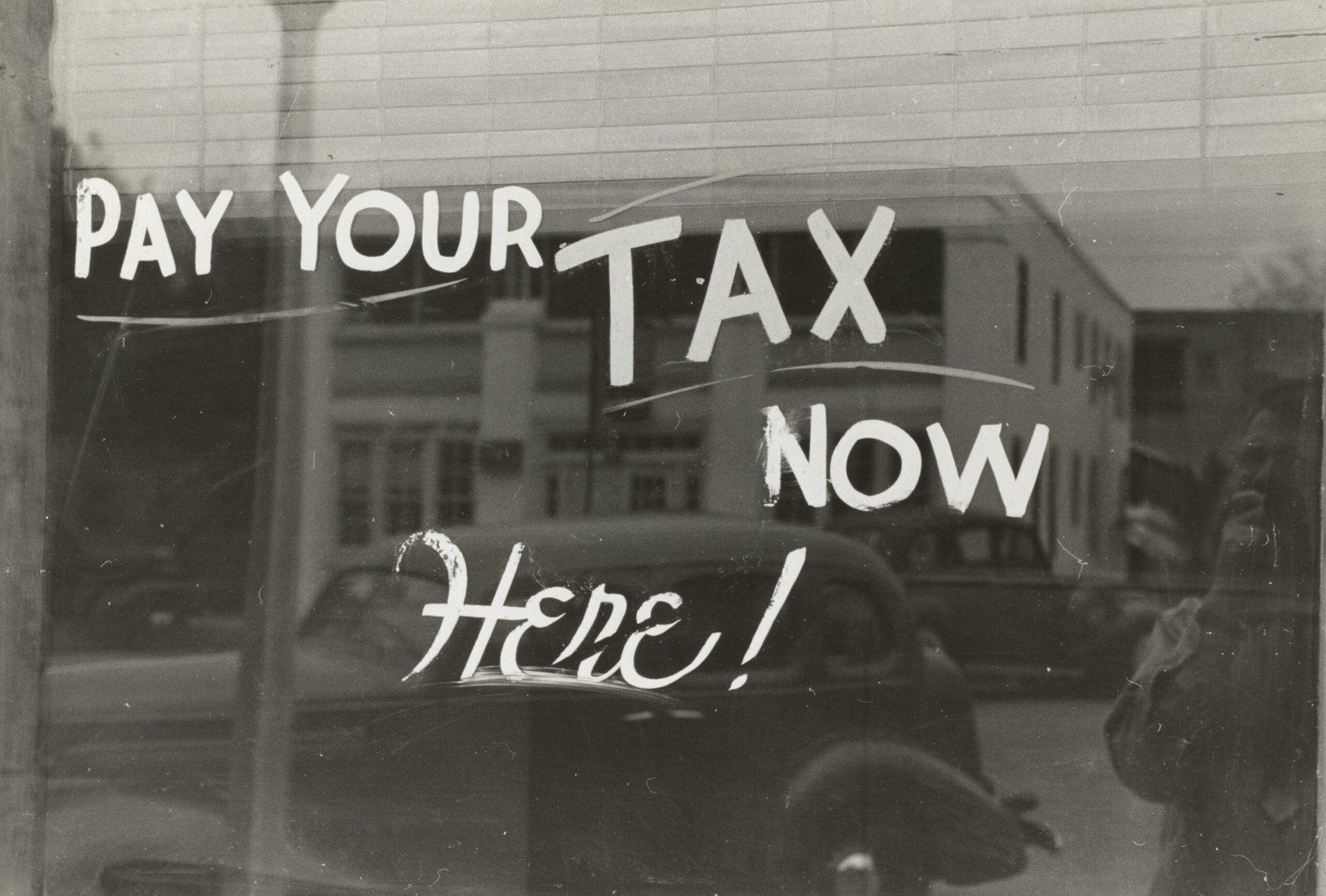

3. Compliance with Tax Regulations:

Taxation is a complex aspect of finance that businesses must navigate. Finance training can help you understand the tax regulations, deductions, and credits applicable to your business. This knowledge enables you to optimize your tax strategy, minimize liabilities, and ensure compliance with legal requirements.

Key Topics in Finance Training

Finance training covers a wide range of topics that are relevant to business and taxation. Some key areas of focus include:

1. Financial Statements:

Understanding financial statements, such as balance sheets, income statements, and cash flow statements, is crucial for assessing the financial health of a business. Finance training teaches individuals how to interpret and analyze these statements to gain insights into a company’s performance.

2. Budgeting and Forecasting:

Effective budgeting and forecasting are essential for planning and managing resources. Finance training provides individuals with the skills to create accurate budgets, forecast future financial performance, and track variances to ensure financial stability.

3. Tax Planning and Strategy:

Tax planning involves developing strategies to minimize tax liabilities while complying with regulations. Finance training helps individuals understand tax laws, deductions, and credits, enabling them to develop effective tax planning strategies that optimize their business’s financial position.

4. Risk Management:

Finance training also covers risk management, which involves identifying, assessing, and mitigating financial risks. By understanding risk management principles, individuals can make informed decisions that protect their business’s financial well-being.

Conclusion

Finance training plays a crucial role in the success of businesses, especially when it comes to tax management. By investing in finance training, individuals and businesses can enhance their financial management skills, make better decisions, and ensure compliance with tax regulations. Whether you’re a business owner or an employee, gaining a solid understanding of finance is a valuable asset that can contribute to your professional growth and the overall success of your business.